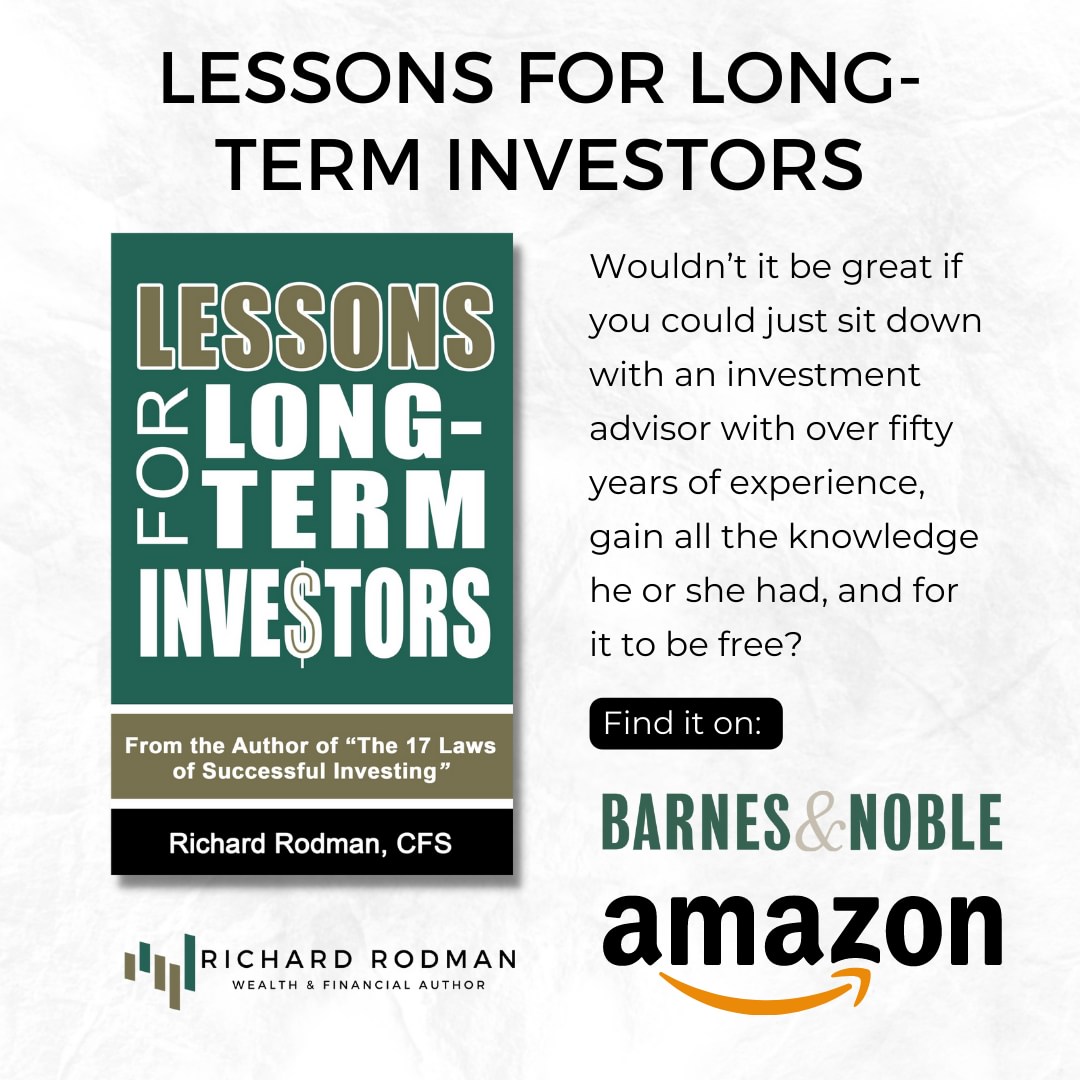

In this interview, we’ll cruise through the concepts of wealth creation and financial acumen with Richard Rodman, an expert in the art of successful investing. With a career spanning over five decades, Rodman has chiseled a path. His latest publication, Lessons for Long-Term Investors, is a distillation of Rodman’s wisdom gathered over the years, from decades of navigating financial landscapes. Seamlessly blending clarity and depth, it shares with readers a wealth creation formula that transcends income brackets, offering a blueprint for navigating the often-turbulent waters of investing. Join us as we learn more about Lessons for Long-Term Investors as well as getting some extra snippets of wisdom from Richard Rodman!

What motivated you to write Lessons for Long-Term Investors?

What motivated you to write Lessons for Long-Term Investors?

What motivated me to write this book is that on looking back over my 50+ year career I have seen a fair amount of people investing on their own. Without the perspective of long-term investing and overreacting to good and bad news, I thought that a reset was for much of the investing population to gain the knowledge and perspective to invest better.

What foundational financial concepts do you believe everyone should understand? How can individuals build a strong base of financial literacy?

Financial literacy is easy to attain. The information needed to be financially literate is all around

us. Hopefully one can start with my book Lessons for Long-Term Investors.

Long-term investing requires a different mindset compared to short-term trading. What are some of the mental shifts that investors should make when transitioning to a long-term investment strategy?

In transferring from a short-term mentality to a long-term mentality it takes away that emotionalism associated with short-term thinking, which will be appealing to investors. This will give them a lot of the reasoning of why to make the change, as most investors get fed up with the emotional issues and difficulty eventually in short-term trading.

The concept of an emergency fund is frequently discussed in personal finance. What advice do you have for establishing and maintaining an adequate emergency fund?

I would have about six months of emergency funds but to each his or her own. Whatever you feel comfortable with. Just don’t make it too much or you will be cheating yourself in the long run as investing should prove to be the more profitable over saving.

Market volatility can test the resolve of long-term investors. How do you address the

topic of managing emotions and staying the course during turbulent market periods in

your book?

It is done two ways. First, when things get emotionally charged, ask yourself if your financial goals have changed. If your portfolio is built around long-term investing as it should be (hence the title of my book Lessons for Long-Term Investor, then short term swings shouldn’t matter and no action should be taken. In the words of Gene Farma Jr., a famous economist “Your money is like a bar of soap. The more you handle it the less you will have.” Secondly, as mentioned, trust history. In a down cycle just wait it out if nothing has changed fundamentally with your individual positions. A disciplined approach to investing will win the day. Yes, it is sometimes boring and sometimes maddening, but it does work.

For someone who is new to investing, what are the fundamental concepts they need to grasp before they start building their investment portfolio?

Know yourself. How much risk tolerance do you have? What are your goals and objectives? Do you have a plan to reach them?

“Time in the market, not timing the market” is a common adage for long-term investors. Could you elaborate on this principle and discuss how you emphasize it in your book?

It is so true. In my 50+ years in this business I have never seen anyone be successful at it consistently. Many have tried and I am not sure why.

Asset allocation is a critical aspect of investment strategy. Could you explain the importance of diversifying investments across different asset classes?

Diversification is the only free lunch in investing. The first consideration is Asset Class diversification such as the breakdown between stocks, bonds, cash and CD’s, real estate, gold, and alternative investments such as art or collectibles. Secondarily, there is also diversification between large companies, mid-sized companies and small companies as well as between sectors of the economy such as technology, communications, consumer staples, consumer discretionary, industrials, materials, health care, etc.

Tax implications can significantly impact an investor’s returns. How does your book

guide readers on tax-efficient strategies for their long-term portfolios?

For the most part, I tend to ignore tax implications. It is one of the Laws in the book. Good decisions trump tax planning. That said, there are choices that pop up which need to be addressed. For example, if a stock needs to be sold and there is just one week to go before it is considered and long-term gain with less tax due, then maybe that is the best course.

How do you convey the power of compounding to someone who is just starting to invest? What role does the length of their investment horizon play?

Get a hold of a compound interest table and it will answer all questions. Einstein was once asked what the greatest invention of mankind was. He answered, “compound interest”. Warren Buffet learned this many years ago.

In the ever-evolving landscape of finance, technological advancements can play a role in shaping investment strategies. How does your book tackle the integration of technology and data analytics in the context of long-term investing?

In the ever-evolving landscape of finance, technological advancements can play a role in shaping investment strategies. How does your book tackle the integration of technology and data analytics in the context of long-term investing?

This is a wonderful question. My personal feeling is that artificial intelligence will have a role in investing now and mostly in the future. However, I am firmly of the belief that human intuition which is gained through real life experiences will be worth more than most technological advancements.

Tax implications can significantly affect investment outcomes. What strategies do you advise for making investments tax-efficient?

I am not a big proponent of having tax planning get in the way of returns. The exceptions are around the margins. An example would be if you had a position that should be sold, but you could wait a small period of time to take advantage of long-term capital gains treatment (a holding period of over one year) to get a lower tax rate on the sale.

Long-term goals often encompass retirement planning and financial security. Can you provide insights from your book on how readers can align their long-term investment strategies with their retirement aspirations?

Another good question. Time is our most important asset. As you get closer to retirement most individuals get more conservative in their investment choices. However, we are all living longer, so even if you are of retirement age there still needs to be planning done for quite a few years in most cases. I would stay with a decent amount of stocks in retirement (in addition to bonds and cash) depending on your risk tolerance.

Setting clear financial goals is crucial. How can someone identify their short-term and long-term financial objectives and create a plan to achieve them?

As mentioned, set a predetermined level of savings each month to move to investments on a disciplined basis (and of course invest what you have currently over and above an emergency fund). Goal should be long-term. Of course, as we age, we do get more conservative most of the time, so adjusting the portfolio is important as well, since our goals might change to more short term at that point.

The financial landscape evolves. What are your recommendations for individuals to stay informed about new investment opportunities, regulations, and trends?

Just keep reading. Today everything is so available. Keep reading and learning about

everything, but specifically about fundamental and technical analysis. They are the cornerstone

of assembling the best possible portfolio.

Find the Author

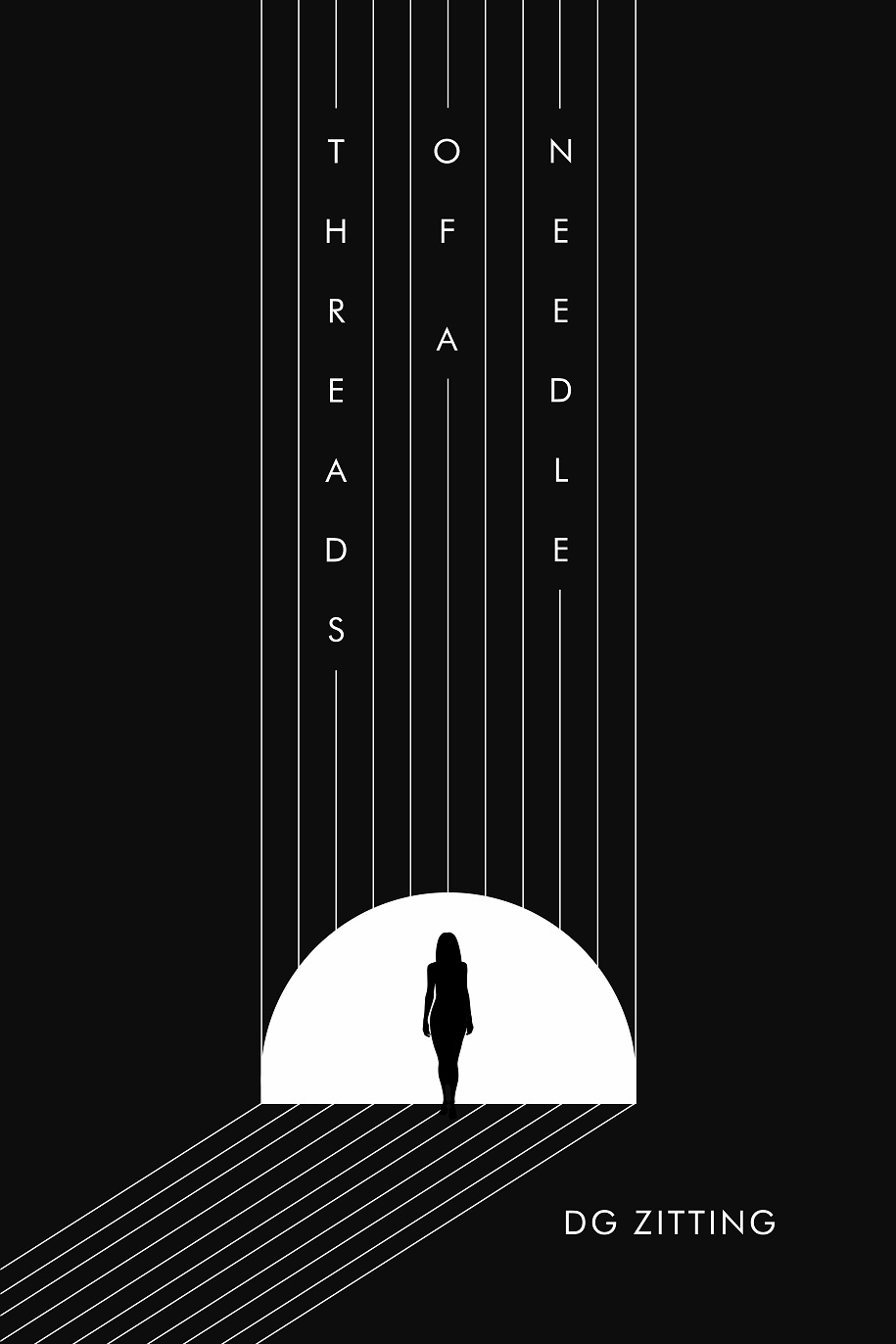

Lessons for Long Term Investors

Master These Lessons and Become a Successful Investor!

Do you want to create more wealth? Do you want to maintain or even add to your standard of living now and during retirement? Now you can if you follow the concepts of this book. With this book, noted investment consultant Richard Rodman shows you:

Do you want to create more wealth? Do you want to maintain or even add to your standard of living now and during retirement? Now you can if you follow the concepts of this book. With this book, noted investment consultant Richard Rodman shows you:

- A wealth creation formula that WORKS!

- How to manage fear and greed–the two emotions that preclude sound investing

- How to put financial markets in their proper perspective and not in the perspective of the media, which mostly reports on short term market swings

- How to capitalize on bad news and market turmoil

This book is a distillation of over 50 years of sound investment advice and practice. It is a companion book to Rodman’s first book, The 17 Laws of Successful Investing, and companion text to his popular seminar, How to Create and Manage Wealth, as well as continuing education material for CPAs. In clear language and powerful examples compiled from many years of his newsletters, Rodman makes long-term investing understandable, easy, and attainable for virtually anyone in any income bracket. In these pages you will hopefully discover a new financial reality in today’s tumultuous world. Your future may actually depend on following these time-honored concepts. Ignore them at your own financial risks.